If you own property in Nagpur or Nashik, you’ve likely encountered NMC property tax. But what does it really mean? How does it affect property owners?

Let’s unpack the concept and explore its practical aspects.

What is NMC Property Tax?

NMC Property Tax refers to the annual charge imposed by the Nagpur Municipal Corporation (NMC) or Nashik Municipal Corporation on properties under their jurisdiction. This tax is essential for funding civic amenities like schools, roads, and waste management while supporting municipal governance.

| Category | Details |

|---|

| Population (Nagpur) | ~2.4 million (approx.) |

| Total Properties | 642,000 (assessed by NMC) |

| Properties Paying Tax | 280,000 |

| Non-Tax Paying Properties | ~362,000 |

| Total Tax Collection (2023) | ₹159 crore |

| Additional Properties Added | 192,000 |

| Number of Zones for Tax Work | Multiple (all NMC zones) |

| Initiatives | Integration of property tax data with city survey office and stamps/registration department. |

Who Needs to Pay It?

Property tax applies to all property owners, whether they own residential homes, commercial spaces, or undeveloped land. Certain exemptions, such as tax rebates for senior citizens or non-profit organizations, may apply, offering financial relief to eligible taxpayers.

For properties with assessment disputes, owners can seek resolution through the NMC grievance redressal system.

Different Types of Property Tax under NMC

Residential Property Tax

This tax is levied on houses and apartments used for living purposes. Exemptions or lower tax rates may apply to economically weaker sections or eco-friendly homes.

Commercial Property Tax

This category includes shops, offices, and other properties used for businesses. These properties often attract higher tax rates due to their potential revenue generation.

Vacant Land Tax

Aimed at discouraging land hoarding, vacant land tax incentivizes owners to utilize their properties for urban development or other productive purposes.

Key Cities Covered by NMC Property Tax

Nagpur’s NMC Property Tax

Nagpur’s system includes user-friendly online portals for tax calculations and payments. Residents can use online tax calculators to estimate their tax liability based on property size, usage type, and location.

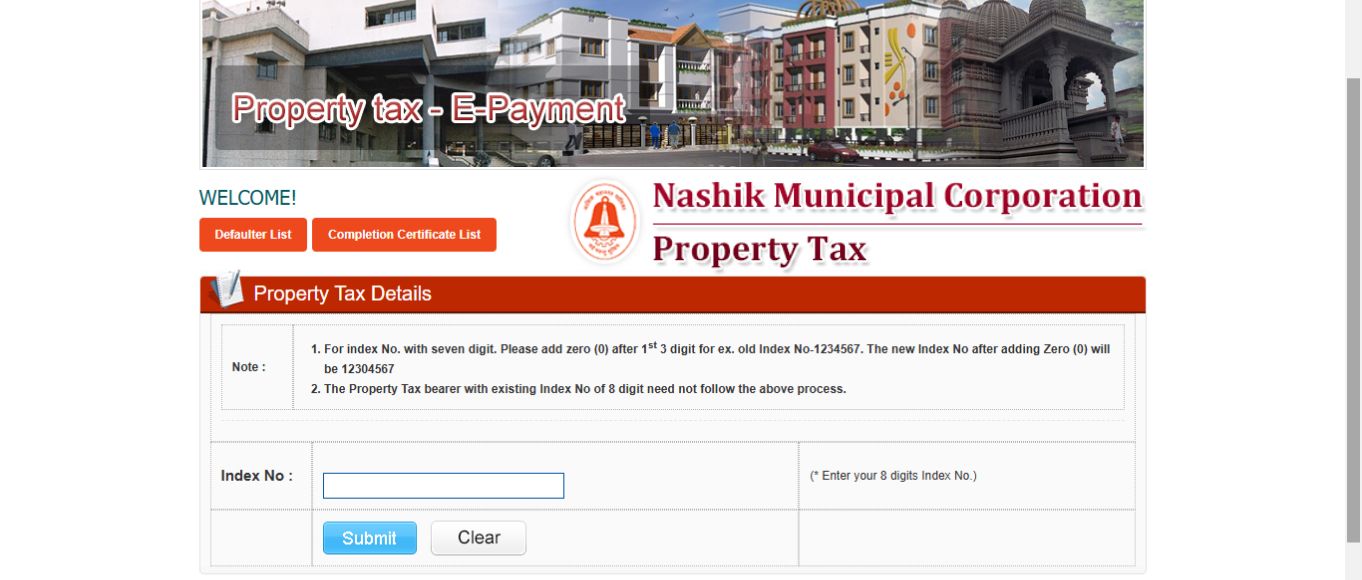

Nashik’s NMC Property Tax

Nashik’s growing infrastructure demands make property tax a key revenue source. Upcoming policy reforms may include revised rates or new incentives for timely compliance.

How to Calculate NMC Nagpur Property Tax?

Factors Affecting Property Tax Calculation

Property Size

Square footage directly impacts the land valuation, with larger properties paying higher taxes.

Location and Zone

Properties in prime urban zones face higher taxes, while those in developing areas enjoy lower rates. Geographical zones play a significant role in tax assessment

Usage Type (Residential/Commercial)

The type of property usage determines the applicable tax rate. Properties with dual-use (residential and commercial) may be taxed proportionally.

Step-by-Step Guide to Calculation

- Determine the Annual Rental Value (ARV): Use NMC’s guidelines to calculate your property’s ARV.

- Apply the Tax Rate: Check the specific rate based on property type and location.

- Account for Exemptions or Rebates: Apply any tax exemptions or rebates you qualify for.

- Finalize Your Property Tax Amount: Multiply the ARV by the rate to determine the final payable amount.

Payment Methods for NMC Property Tax

Online Payment Options

NMC Nagpur Property Tax Online Portal

The portal supports multiple payment gateways, offering residents ease of access. Taxpayers can also view past payment history and file grievances online.

Benefits of Online Payment

- Instant confirmations and receipts.

- Access to digital records for financial planning.

- Eco-friendly and paperless transactions.

Offline Payment Options

For residents unfamiliar with digital platforms, NMC offices offer offline payment facilities. Remember to bring all required property documents for smooth processing.

Benefits of Paying NMC Property Tax on Time

Avoiding Penalties

Late payments attract penalties, which can escalate over time. NMC’s compliance regulations emphasize punctuality to avoid fines.

Contribution to Urban Development

Your tax payments support the expansion of public infrastructure, including parks, community centres, and waste management systems.

Challenges Faced by Taxpayers

Common Errors in Payment

Mistakes like incorrect property details, calculation errors, or missed deadlines can lead to penalties or disputes.

Lack of Awareness

Many property owners are unaware of tax exemptions, online portals, or deadlines, which complicates compliance.

Steps to Resolve Disputes and Issues

Filing a Grievance with NMC

The official grievance redressal system allows taxpayers to report issues related to incorrect assessments or failed payments. Most cases are resolved within 30 days.

Common Dispute Resolution Scenarios

- Assessment disputes: If the assessed ARV seems incorrect, property owners can request a reassessment.

- Payment errors: Mistakenly paid amounts can be adjusted in future bills or refunded upon request.

FAQs

What is NMC Nagpur Property Tax?

It’s an annual tax levied on property owners within Nagpur’s municipal jurisdiction.

How can I pay NMC property tax online?

Visit the official NMC portal, calculate your tax using the online tax calculator, and pay via multiple payment options.

Are there any exemptions available?

Yes, exemptions may apply to senior citizens, non-profit organizations, or eco-friendly properties.

What happens if I don’t pay my NMC property tax on time?

Penalties will be levied, and prolonged non-payment can lead to legal action.

How do I resolve a dispute over my property tax assessment?

File a grievance with the NMC’s redressal system for reassessment or error correction.

How do I pay property taxes online in NMC Nagpur?

Visit the NMC Nagpur official website, navigate to the property tax section, enter your property details or index number, and make the payment using the available online methods.

How to calculate property tax in Pune?

Property tax in Pune is calculated using the formula:

Tax = Base Value × Built-up Area × Usage Factor × Type Factor × Age Factor × Zone Factor

What is the property tax rate in Nagpur?

The property tax rate in Nagpur varies based on property usage (residential or commercial), location, and size. Check the official NMC website for detailed rate slabs.

How to calculate tax on property?

Property tax is typically calculated using the formula:

Annual Rental Value × Tax Rate – Applicable Exemptions.

How to pay green tax online in Nagpur?

Green tax can be paid through the NMC Nagpur website under the environmental tax section. Provide property details and proceed with the payment.

How to pay home tax online in Maharashtra?

Visit your municipal corporation’s website (e.g., NMC Nagpur), go to the property tax section, and pay using your property details or index number.

What is the property tax amnesty scheme in Pune 2024?

This scheme allows property owners to clear outstanding dues with reduced penalties. Visit the Pune Municipal Corporation (PMC) website for detailed eligibility criteria.

What is the exemption of property tax in Pune?

Exemptions are provided for properties owned by freedom fighters, war widows, senior citizens, and charitable trusts. Check specific criteria with the PMC.

What is the property tax discount in Maharashtra?

Discounts may vary by municipal corporation, typically ranging from 10%–to 40% for early payments or senior citizens.

What is the PCMC property tax exemption?

PCMC offers property tax exemptions for certain categories, such as government buildings, charitable institutions, and properties owned by senior citizens or war widows.

How to check property details online in Nagpur?

Visit the NMC property tax portal, enter your property ID or UPIN, and access details like ownership, tax dues, and payment history.

How to find the index number of property tax?

The index number is available on your previous tax receipts or can be retrieved from the NMC portal by entering basic property details.

What is UPIN in property tax?

UPIN stands for Unique Property Identification Number. It is assigned to each property for easy identification and tax management.

How to find the assessment number for property tax?

The assessment number is provided in your property tax bill or can be searched on the NMC website using property details.

What is the full form of NMC Nagpur?

NMC stands for Nagpur Municipal Corporation.

How many zones are there in Nagpur?

Nagpur is divided into 10 administrative zones under the Nagpur Municipal Corporation.

How to apply for a property card in Nagpur?

Visit the local revenue office or apply online through the NMC portal. Submit necessary property ownership documents and pay the applicable fee.

What is the charge for a property tax name change in Pune?

The fee for a name change varies depending on the municipality. In Pune, it is usually nominal. You also need to provide ownership documents.

What is the property tax rate in India in 2024?

Property tax rates differ by state and municipality, ranging between 5%–20% of the annual rental value or market value.

Can we get tax exemption on property purchases?

Tax exemptions are available under certain conditions, such as buying affordable housing or investing in government schemes.