Property tax forms the foundation for urban development, and the KDMC Property Tax is no different. Managed by the Kalyan-Dombivli Municipal Corporation (KDMC), this tax supports not just basic infrastructure development but also efforts toward smart city initiatives and sustainable urban governance.

Paying your KDMC property tax is more than a legal obligation; it’s your contribution to the city’s growth, sustainability, and progress. By staying informed about key deadlines, incentives, and online tools, you can ensure a hassle-free experience while supporting initiatives that improve the quality of life for everyone.

Understanding KDMC: A Backbone of Municipal Governance

Kalyan-Dombivli Municipal Corporation (KDMC) manages key civic amenities in one of Maharashtra’s fastest-growing urban clusters. From ensuring proper waste disposal to maintaining robust road networks, KDMC’s efficient municipal governance is funded heavily by property tax collections.

Why KDMC Property Tax Matters?

Property tax is crucial for enabling sustainable development. It facilitates projects ranging from environmentally friendly public spaces to the modernization of civic amenities. Your contributions are reinvested into building a cleaner, greener, and smarter city.

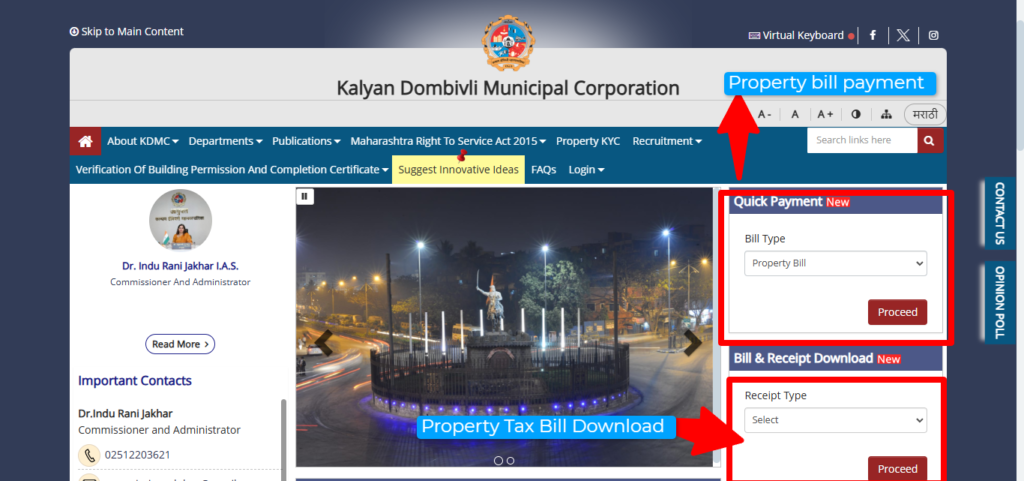

How to Pay KDMC Property Tax Online?

- Access the KDMC Portal

- Visit the official KDMC Property Tax Payment Portal.

- Login or Register

- Use existing credentials or sign up as a new user.

- Complete the Payment

- Enter your property details and select payment options like UPI, credit/debit cards, or net banking

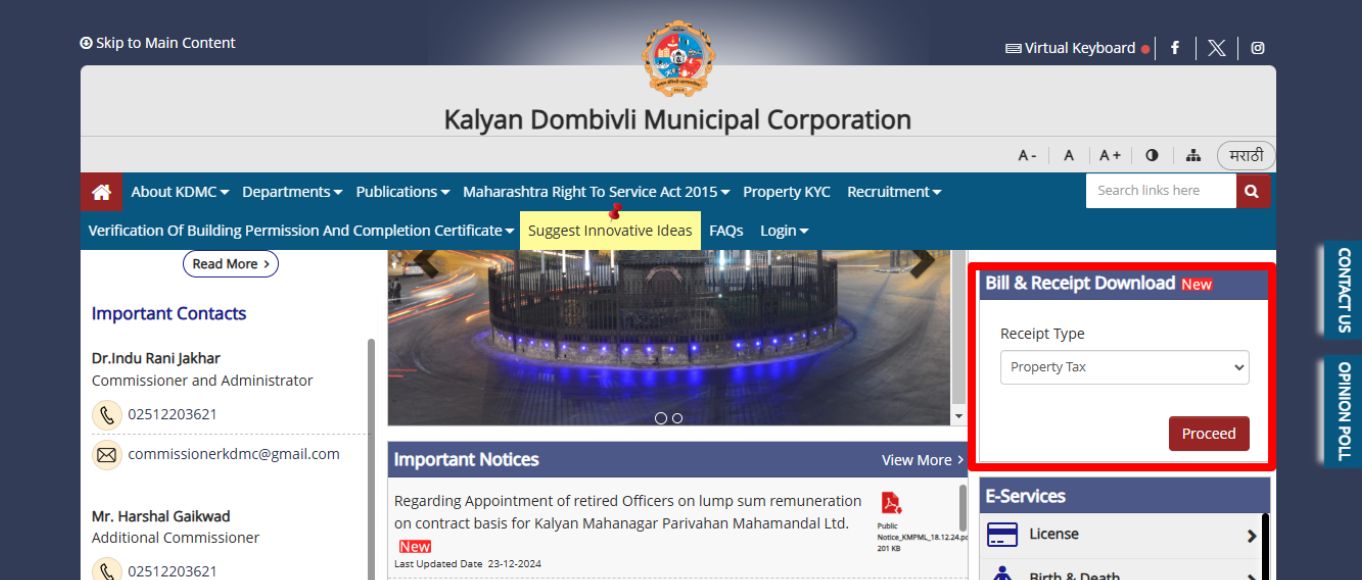

www.kdmc.gov.in property tax bill download

KDMC Contact Numbers

- Phone:

+91 25 1220 6205,

+91 25 1220 6207 - Mobile:

+91 25 1220 6206,

+91 25 1220 3621

Advantages of Online Payment

Online payments offer convenience, speed, and enhanced security. Taxpayers receive instant digital receipts for record-keeping.

What Happens If You Miss the Due Date?

Missing your property tax due date could attract penalties or additional interest. Staying updated through reminders is essential for avoiding these charges.

Using the KDMC Property Tax Calculator

The calculator simplifies estimating your tax liability, considering factors like property size, usage, and location. This helps taxpayers plan their finances better.

Special Guidelines for Badlapur Residents

Tax slabs in Badlapur differ from other KDMC areas. Ensure compliance by checking area-specific tax rates and staying informed about recent developments in taxation policies.

KDMC Property Tax Discounts and Incentives

KDMC encourages timely tax payments by offering early payment discounts and special concessions for specific groups, such as senior citizens and differently-abled property owners. These measures ensure inclusivity while fostering a culture of civic responsibility.

Steps for Changing Name on KDMC Property Records

If you’ve recently purchased a property, it’s mandatory to update ownership details. Here’s how:

- Collect Necessary Documents

- Gather proof of ownership, such as the sale deed or a NOC from the previous owner.

- Submit the Application Online or at the KDMC Office

- Apply via the KDMC online portal or submit documents physically at the nearest office.

- Verification Process

- KDMC will verify your documents, after which the name change will be reflected in the records.

Environmental Impact of Property Tax Utilization

Did you know that part of KDMC property tax revenue is allocated to sustainable initiatives like creating green spaces, maintaining biodiversity parks, and installing energy-efficient streetlights? By contributing your tax, you’re helping build an eco-friendly future.

Resolving Common Issues with KDMC Property Tax

- Login Troubles: Forgot your credentials? Use the ‘Forgot Password’ option or contact KDMC support.

- Incorrect Tax Amount: If discrepancies arise, file a complaint through the portal or visit the KDMC office for resolution.

- Understanding Exemptions: Certain properties, such as those owned by charitable organizations, may qualify for tax exemptions. Check eligibility with KDMC.

KDMC Property Tax for Smart City Goals

KDMC is gradually aligning with smart city principles, using property tax revenue to implement:

- Digitization of public services.

- Improved waste management systems.

- Development of efficient transportation networks.

FAQs

How can I claim a tax exemption for my property?

Check eligibility for exemptions on the KDMC portal or contact their help desk for guidance.

What penalties are applied for late tax payments?

KDMC imposes fines and interest based on the overdue duration. It’s best to pay on time to avoid penalties.

How does KDMC use property tax revenue for environmental projects?

Revenue is allocated for green spaces, waste management improvements, and energy-efficient infrastructure.

What happens if I don’t update ownership details after buying a property?

Failure to update ownership may result in legal issues or delays in receiving tax notifications.

Are there different tax rates for commercial and residential properties?

Yes, KDMC applies distinct tax slabs for residential, commercial, and industrial properties. Use the tax calculator to estimate your liability accurately.

How to check property tax online for KDMC?

You can check your KDMC property tax details online by following these steps:

Visit the official KDMC (Kalyan-Dombivli Municipal Corporation) website.

Navigate to the property tax section.

Enter your property details, such as Property ID or Owner Name.

View your property tax information, including outstanding dues.

How to download the KDMC property tax bill?

To download your property tax bill:

Go to the KDMC property tax portal.

Log in using your credentials or property ID.

Search for your property record.

Click on the “Download Bill” or “Print Tax Bill” option to save it.

How to pay KDMC property tax online?

Visit the KDMC property tax payment portal.

Enter your property ID or other required details.

Verify the outstanding tax amount.

Choose a payment method (credit card, debit card, net banking, or UPI).

Complete the transaction and save the receipt for future reference.

How to get the property tax receipt online for KDMC?

Log in to the KDMC official website.

Go to the payment history section under the property tax tab.

Enter your property ID or receipt number.

Download and print your payment receipt.