When it comes to owning property, one critical aspect to consider is “property tax regulations.” For residents of Vasai Virar City, this is where VVMC property tax comes into play. If you’re wondering what it is, why it matters, and how to pay it, you’re in the right place.

Let’s break it down step by step.

What is VVMC Property Tax?

VVMC property tax is the levy imposed by the Vasai Virar Municipal Corporation (VVMC) on property owners within its jurisdiction. This tax contributes to the city’s growth and maintenance, funding everything from roads to sustainable sanitation practices.

Overview of Property Tax in India

In India, property tax is a crucial revenue source for municipal bodies. It’s calculated based on the property’s value and is payable annually, with specific exemptions available for nonprofits and certain categories like senior citizens.

Role of VVMC in Property Tax Collection

VVMC ensures smooth tax collection and uses these funds for key urban development initiatives, including improving infrastructure and public services, and ensuring equitable revenue allocation.

Why is Property Tax Important?

Funding Urban Development

Ever wondered how your city gets its roads fixed or new parks built? Property tax plays a big role in these developments. Your contribution helps make the city a better place while promoting sustainability and long-term growth.

Maintaining Civic Amenities

From energy-efficient streetlights to modernized waste management systems, the VVMC relies on property tax to maintain essential services.

How to Pay VVMC Property Tax Online?

Steps for Online Property Tax Payment

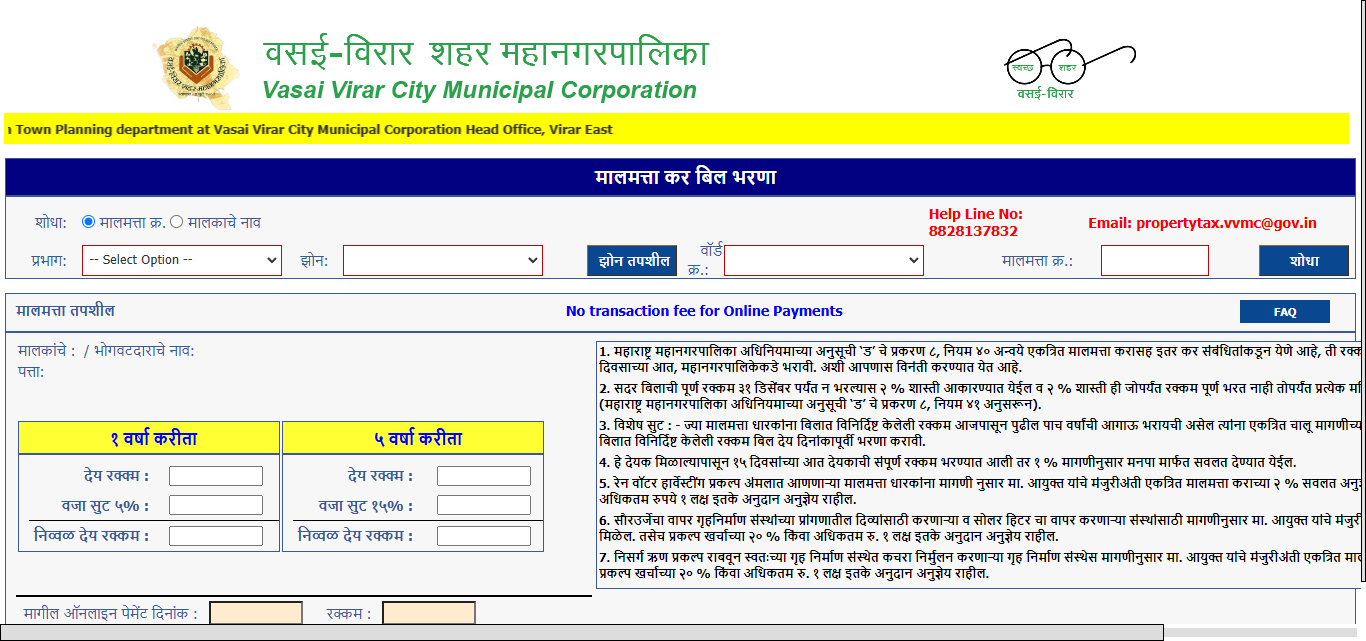

Accessing the VVMC Portal – https://onlinevvcmc.in/VVCMCOnlinePGProp/

Start by visiting the official VVMC website. It’s your gateway to seamless online property tax payments.

Click on Property No. or Owner Name

Select ward and Zone and fill remaining details

Logging In or Registering:

If you’re a first-time user, you’ll need to create an account. Existing users can log in with their credentials.

Navigating to the Property Tax Section:

Once logged in, head to the property tax section, where you’ll find your tax details.

Making a Secure Payment:

Choose your preferred payment method, including mobile app options, enter your details, and confirm the payment. Don’t forget to download the receipt for your records.

Keep in Mind

- Payment Deadline:

Property tax and related dues must be paid to the Municipal Corporation within 15 days of receiving the payment notice (as per Maharashtra Municipal Corporation Act, Chapter 8, Rule 40). - Penalty for Late Payment:

If the full payment is not made by 31st December, a 2% penalty will be charged on the total bill each month until it is fully paid (as per Rule 41). - 5-Year Advance Payment Exemption:

Property owners who pay their taxes in advance for the next five years will receive a 15% discount on the current tax demand. Payments must be made before the bill’s due date. - Early Payment Discount:

If the full tax amount is paid within 15 days of receiving the payment notice, the Municipal Corporation will offer a 1% discount on the total bill. - Rainwater Harvesting Incentive:

Property owners implementing rainwater harvesting projects will receive:- 2% discount on property tax (after approval by the Commissioner).

- A subsidy of 20% of the project cost or a maximum of ₹1 lakh.

- Solar Energy Incentive:

Housing societies using solar energy for lighting or solar heaters will receive:- 2% discount on property tax (after approval by the Commissioner).

- A subsidy of 20% of the project cost or a maximum of ₹1 lakh.

- Nature Loan and Waste Management Incentive:

Housing societies implementing waste management or nature loan projects will receive:- 2% discount on property tax (after approval by the Commissioner).

- A subsidy of 20% of the project cost or a maximum of ₹1 lakh.

Benefits of Paying Property Tax Online

- Convenience and Time-Saving: Why stand in queues when you can pay from the comfort of your home? The online process is fast and hassle-free.

- Digital Receipts and Transparency: Online payments provide instant receipts, ensuring transparency and accuracy in records.

Common Issues and Solutions

- Login Troubles: Forgot your password? No worries—VVMC’s portal has an easy password recovery option.

- Payment Gateway Errors: Sometimes, payments fail due to technical glitches. Ensure your internet connection is stable.

How to Resolve These Issues?

- Contacting VVMC Helpdesk: VVMC’s support team is just a call or email away to resolve any issues.

- Ensuring Proper Documentation: Keep your property details and payment proof handy to avoid discrepancies.

FAQs

What is the penalty for late payment?

Late payments attract penalties, typically a percentage of the outstanding amount.

Can I pay property tax offline?

Yes, you can visit VVMC’s designated centers to pay in person.

How is the property tax calculated?

It’s based on factors like property type, size, and location.

Is property tax applicable for vacant land?

Yes, but the rates for vacant land differ from developed properties.

How can I update property details?

Log in to the VVMC portal, navigate to the property section, and submit the updated details.

What are Corporation Office working Days and Times?

Monday to Friday: 10:00 am to 06:00 pm

What is your helpdesk Contact number and working time?

8828137832, Monday to Sunday between 9 am to 8 pm.

How can I make my bill payment online for the Property / Water Bill? changes?

You can pay your bill on the website www.vvcmc.in or by vvcmc Vclick app https://play.google.com/store/apps/details?id=com.eis.vvcmcapp You visit vvcmc website go to pay your property tax tab or pay your water tax, you need to enter zone, ward no, property number and click on search button and your details will be displayed on screen.

Click on “BHARNA KARA” to make payment. you can make payment by Net banking / Debit or Credit Card / BBPS.Email ID and Mobile Number are mandatory while making payment.

How do I download my Payment Receipt?

Once you complete the payment process confirmation message will be sent to your mobile number, and the receipt will be sent to your registered email ID. You can also visit to VVCMC website and enter your zone, ward and property number. Once your property details are displayed you can able to view the download receipt option.

How will I know the status of the payment after paying the property tax/water tax online?

After paying the tax, you will receive a message on the mobile number you provided while making the payment that the payment has been successful. Also, fill in the information asked in the same way as you filled in the details for the payment on the municipal website and click on the search button. There you can go to the download receipt option and see if the tax payment has been made.

If I make a payment at the Office, can I view the receipt online?

No, you can’t view your payment receipt online. It would help if you visited the nearest prabhag samiti Office.

If I make a payment at the Office, can I view the receipt online?

The receipt of the tax paid at the Office is currently not available online. You should visit the nearest municipal Office for this receipt.

Can I make a 5 years payment? Will I get any Discount?

Yes, you can make a 5-year payment, but the discount offers are only valid for 15 days from the date of the bill received. (The bill received date is mentioned on the bill)

Will I get a discount on property tax if I pay 5 years of payment?

As per the rules of the Municipal Corporation, we can pay 5 years of payment, but if you pay the full amount of the payment within 15 days of receiving this discount bill, you will get a discount as per the prevailing rules.

How can I change my name on Property Tax?

You need to visit the nearest VVCMC office for more details.

What is the method of property name transfer/transfer?

For transfer or name transfer, you can visit the Municipal Corporation office to know the complete process.

Unable to view my Property Tax details while doing online payment.

You can contact our online VVCMC helpline no. 8828137832 and mail at Email ID: [email protected]

My property tax details are not visible while paying online payment.

If you are not seeing your tax bill due to some technical reason, you can contact the helpline number 8828137832 or you can also mail to the email id [email protected].

How do I contact VVCMC for any queries or service requests?

For any queries, you can contact us at 8828137832 or email us at [email protected]