Managing property taxes is a crucial responsibility for property owners in Navi Mumbai. The Navi Mumbai Municipal Corporation (NMMC) oversees property tax collection to fund civic infrastructure, urban development, and smart city initiatives.

Paying your NMMC property tax on time not only avoids penalties but also supports the development of Navi Mumbai as a smart and sustainable city. By leveraging online tools and GIS mapping, you can make the process hassle-free and efficient. Take advantage of NMMC’s modernized services to stay updated and compliant.

| Online Property Tax Payment | https://www.nmmc.gov.in/property-tax2 |

| Property Search | https://www.nmmc.gov.in/property-search |

| Ward Name: | Belapur Nerul Vashi Turbhe Kopar Khairane Ghansoli Airoli Digha Head Office |

| Property Tax Calculator | https://www.nmmc.gov.in/self-assessment-of-property-tax |

| Amnesty Scheme for Property Tax | https://www.nmmc.gov.in/property-tax-amnesty |

| New Property Taxation | https://app.nmmconline.in/online-rts/application-service-form/0190c545-3ab5-7771-ab2e-c8720d159ce5 |

| Helpline No: | 1800 222 309, 1800 222 310 |

| Address | Ground Floor, Sector-15 A, Palm Beach Junction, CBD Belapur, Navi Mumbai, Maharashtra-400614 |

What Is NMMC Property Tax?

Definition and Purpose

NMMC property tax is a mandatory levy on property owners within the Navi Mumbai Municipal Corporation jurisdiction. It funds essential services like roads, water supply, waste management, sustainable infrastructure, and public amenities.

Importance of Property Tax in Civic Administration

Property tax revenue directly contributes to the development and maintenance of urban infrastructure, ensuring better living standards for residents and advancing smart city goals.

Components of NMMC Property Tax

Tax Calculation Basis

NMMC calculates property tax based on several factors:

- Built-Up Area: The larger the built-up area of your property, the higher the tax liability.

- Location and Property Usage: Tax rates vary based on the property’s location (ward) and its use (residential, commercial, or industrial).

- Applicable Tax Rates: NMMC updates tax rates periodically, which can be checked on their official website.

Penalties and Discounts

Timely payment can fetch discounts, while delays may lead to penalties.

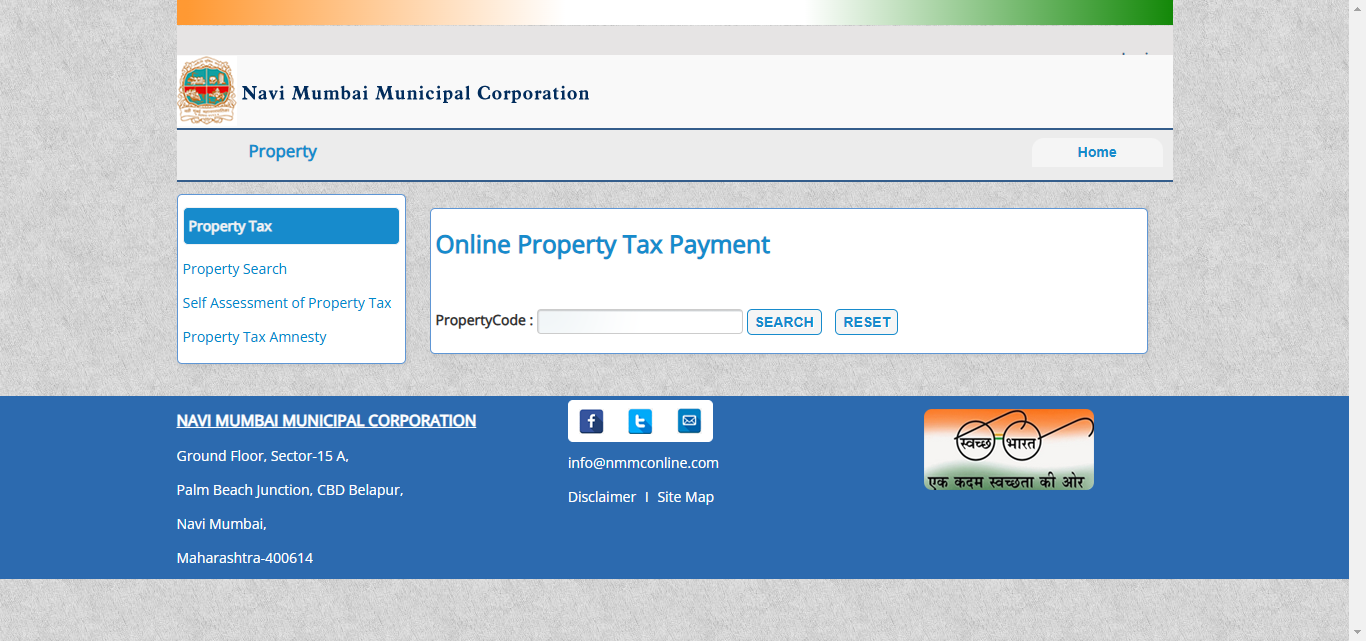

How to Pay NMMC Property Tax Online?

Step-by-Step Process

- Visit the official NMMC website.

- Navigate to the “Property Tax Payment” section.

- Enter your property details or tax number.

- Verify the tax amount.

- Choose your payment method and complete the transaction.

Accepted Payment Methods

You can pay using net banking, credit/debit cards, or UPI.

How to Change Name in Property Tax Online NMMC?

Required Documents

- Proof of ownership (sale deed, gift deed, etc.)

- Previous property tax bill

- Identity proof of the new owner

Step-by-Step Process

- Visit the NMMC portal and log in.

- Navigate to the “Name Change” section.

- Upload the required documents.

- Apply and wait for approval.

Benefits of Paying NMMC Property Tax Online

- Convenience and Time-Saving: Online payment eliminates the need for physical visits, saving time and effort.

- Transparency and Record-Keeping: Online transactions provide instant receipts, ensuring transparency and accurate records.

Property Tax for New Properties

Registration and Assessment Process

New property owners must register their property with NMMC for tax assessment.

Online Application Process

Applications can be submitted through the NMMC online portal.

FAQs

How can I pay my NMMC property tax online?

Visit the NMMC website, enter your property details, and complete the payment using any online payment method.

What should I do if I can’t find my property tax number?

Use the property search tool on the NMMC portal or contact their helpline for assistance.

Can I pay my property tax offline?

Yes, you can visit the NMMC office or authorized centres to pay offline.

How do I apply for a name change on my property tax bill?

Log in to the NMMC portal, submit the required documents, and follow the name change process.

Are there any penalties for late payment?

Yes, delayed payments attract penalties. Check the NMMC website for specific details.