Paying TMC property tax is more than a legal obligation—it’s a chance to contribute to Thane City’s growth, community development, and sustainability initiatives. With digital tools like the TMC portal and the property tax app, managing your taxes is more accessible than ever.

What is TMC Property Tax?

The TMC property tax is a mandatory annual tax levied by the Thane Municipal Corporation (TMC) on property owners within its jurisdiction. This tax is a vital source of revenue that funds civic services like roads, public transportation, and waste management, along with broader infrastructure development initiatives.

Overview of Thane Municipal Corporation (TMC)

TMC is the governing body responsible for administering and developing the Thane district. It oversees public utilities and essential services while integrating technology solutions such as automated payments and AI-based tax estimation for greater efficiency.

Purpose of Property Tax

Property tax ensures that the city’s infrastructure and services evolve with its growing population. It funds initiatives such as community development, educational support, and efforts to improve the city’s environmental impact.

Key Features of TMC Property Tax

Every property owner within TMC’s jurisdiction, including residential, commercial, and industrial properties, as well as vacant land, is obligated to pay property tax annually.

Additional Benefits

Paying property tax on time offers benefits such as tax rebates, contributions to community welfare projects, and support for inclusive services that ensure equitable resource distribution.

How TMC Property Tax is Calculated?

Several factors influence the calculation of property tax:

- Property Type: Residential properties are taxed at lower rates compared to commercial or industrial properties.

- Built-up Area: Larger properties incur higher tax liabilities.

- Location and Zone: Properties in high-demand zones attract higher taxes.

Formula for Calculation

Property Tax = Tax Rate × Built-up Area × Base Value × Zone Factor

Example:

- Identify the built-up area (e.g., 1,000 sq. ft.).

- Check the base value and zone factor for your location.

- Multiply by the applicable tax rate.

Paying Your TMC Property Tax

Convenient Payment Options

TMC offers various payment options, including:

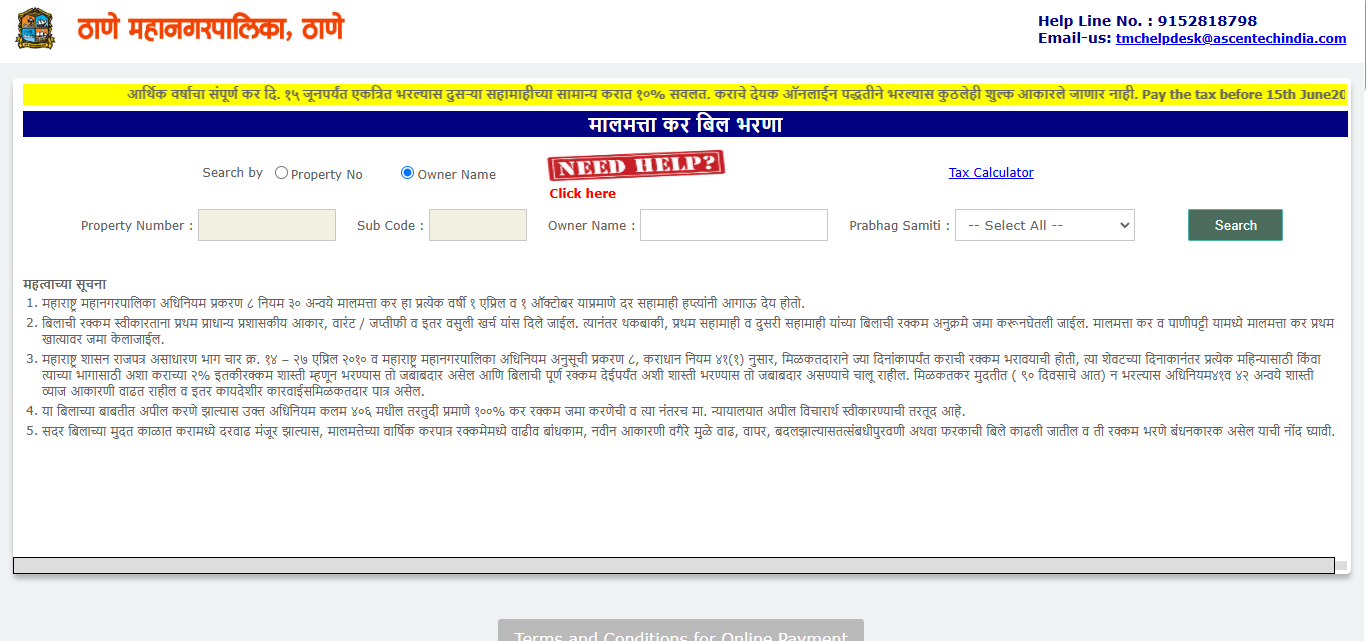

- Online Payments: Through the official TMC website, the TMC property tax app, or using QR code payments.

- Offline Payments: At TMC offices or authorized banks.

TMC Property Tax Bill Download, Click Here

Managing TMC Property Tax Records

Name Change and Property Tax Transfers

New property owners can apply for a name change in the tax records by submitting ownership documents. Similarly, during property transfers, the tax records should be updated to reflect the new ownership.

Benefits of Paying TMC Property Tax on Time

Timely payment helps you:

- Avoid Penalties: Prevent hefty fines or legal complications.

- Support Civic Development: Your contributions aid public awareness campaigns and multilingual support services to make resources more accessible.

FAQs

How is TMC property tax calculated?

TMC calculates property tax based on factors like property type, area, location, and the applicable tax rate.

How to download each year’s TMC property tax receipt?

Log in to the TMC portal, navigate to the receipts section, and select the year to download.

How to get TMC property tax receipts?

Access the “Past Receipts” section on the TMC portal, enter the required details, and download the receipts.

When does the property tax year start in TMC?

The property tax year typically starts in April, aligning with the financial year.

What is the TMC property tax app?

NO mobile app available till date