Paying MCG property tax is not just a legal duty—it’s a step toward making Gurgaon a greener, smarter, and more livable city. Your contribution fuels vital initiatives like urban planning, sustainability projects, and community awareness programs.

What is MCG Property Tax?

MCG Property Tax refers to the mandatory tax levied by the Municipal Corporation of Gurgaon (MCG) on properties within its jurisdiction. It ensures the funding of crucial civic services such as road maintenance, waste management, environmental initiatives, and public infrastructure development.

Definition and Purpose

Think of property tax as your way of keeping the city functional and sustainable. Every property owner in Gurgaon—whether residential, commercial, or industrial—must contribute to maintaining public services and supporting urban planning initiatives.

Who Needs to Pay MCG Property Tax?

If you own a property in Gurgaon, you’re required to pay MCG property tax annually. This responsibility extends to residential, commercial, and industrial property owners.

Importance of Paying Property Tax

Legal Obligations

Skipping property tax payments can result in severe consequences, including tax notices, penalties, legal notices, and even property seizure in extreme cases.

Contribution to Civic Amenities

Your taxes fund Gurgaon’s development projects, including green spaces, public parks, modern drainage systems, and even renewable energy projects, ensuring a cleaner and more sustainable city.

How to Calculate MCG Property Tax?

Factors Affecting Property Tax in Gurgaon

- Type of Property: Residential, commercial, or industrial properties have different tax rates.

- Location of Property: Prime areas like DLF or Sushant Lok attract higher taxes due to their premium valuation.

- Property Usage: Commercial properties are taxed higher due to their income-generating potential.

MCG Property Tax Rates for 2025

- Residential: ₹1-₹5 per square foot.

- Commercial: ₹4-₹12 per square foot.

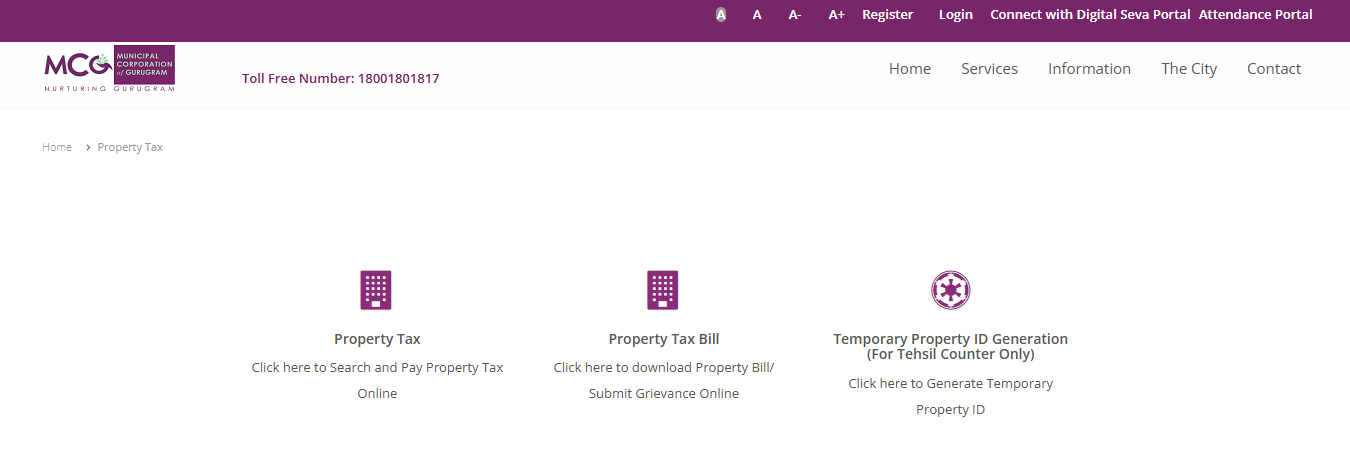

Steps to Pay MCG Property Tax Online

- Accessing the Official Website

- Visit www.mcg.gov.in to start the payment process.

- Logging into Your Account

- Use your property ID or register using your mobile number.

- Making the Payment

- Double-check your property ID and select your preferred payment method, including credit/debit cards, QR code payments, or net banking.

Common Issues and Resolutions

Errors During Online Payment

Ensure a stable internet connection. Persistent issues can be resolved via the MCG helpline.

Incorrect Property Details

Update records by submitting documents like sale deeds mutation certificates or contacting customer support for guidance.

FAQs

What happens if I don’t pay my MCG property tax?

Non-payment can result in legal notices, penalties, and property seizure.

How do I find my property ID for tax payments?

Your property ID can be found in previous tax receipts or sale documents.

Can I pay through a mobile app?

Yes, MCG offers a mobile app for seamless tax payments.

Are there discounts for early payment?

MCG frequently announces discounts for early taxpayers. Stay updated on the website.

What if I overpay?

You can request a refund or adjustment by submitting a claim to the MCG support team.