Owning property in Mumbai comes with its fair share of responsibilities, and one of the most important is paying the Brihanmumbai Municipal Corporation (BMC) property tax. Whether you’re a seasoned homeowner or a new property buyer, understanding how this tax works can save you time, effort, and even money.

Managing your BMC property tax doesn’t have to be overwhelming. With online tools, clear guidelines, and support for resolving issues like incorrect calculations or missing receipts, you can ensure compliance while contributing to the city’s growth.

Don’t forget to explore eco-friendly initiatives funded by these taxes – your contributions are shaping a better Mumbai. Pay on time, set reminders, and make the most of available discounts or rebates.

Let’s dive into everything you need to know about BMC property tax, including property tax rules, exemptions, and modern payment options like mobile apps.

What is BMC Property Tax?

BMC property tax is a municipal tax imposed by the Brihanmumbai Municipal Corporation (BMC) on properties within its jurisdiction. This tax ensures that the city’s infrastructure, sanitation, and public services are well-maintained, supporting initiatives like green infrastructure and eco-friendly municipal projects. Think of it as your contribution to making Mumbai a cleaner, greener, and more livable city.

Importance of Paying Property Taxes

Paying property tax isn’t just a legal obligation; it also ensures uninterrupted municipal services like roads, water supply, and waste management. Additionally, timely payments can help you avoid penalties and benefit from potential early payment discounts or tax rebates.

How is BMC Property Tax Calculated?

Factors Affecting Property Tax Calculation

The amount you pay as property tax depends on various factors, such as:

- Property size and location

- Type of property (residential, commercial, or industrial)

- Age of the property

- Amenities available in the area

Calculation Formula

The BMC uses a comprehensive formula to calculate property tax, considering:

- The base value of the property

- Multiplication factors based on property usage and location

- Age-based depreciation or appreciation

For precise calculations, use the property tax calculator available on the BMC website or their mobile app.

How to Pay BMC Property Tax?

Offline Payment Methods

For traditional methods, visit your local ward office with your property details and tax bill.

BMC Online Property Tax Payment

Step-by-Step Guide to Online Payment

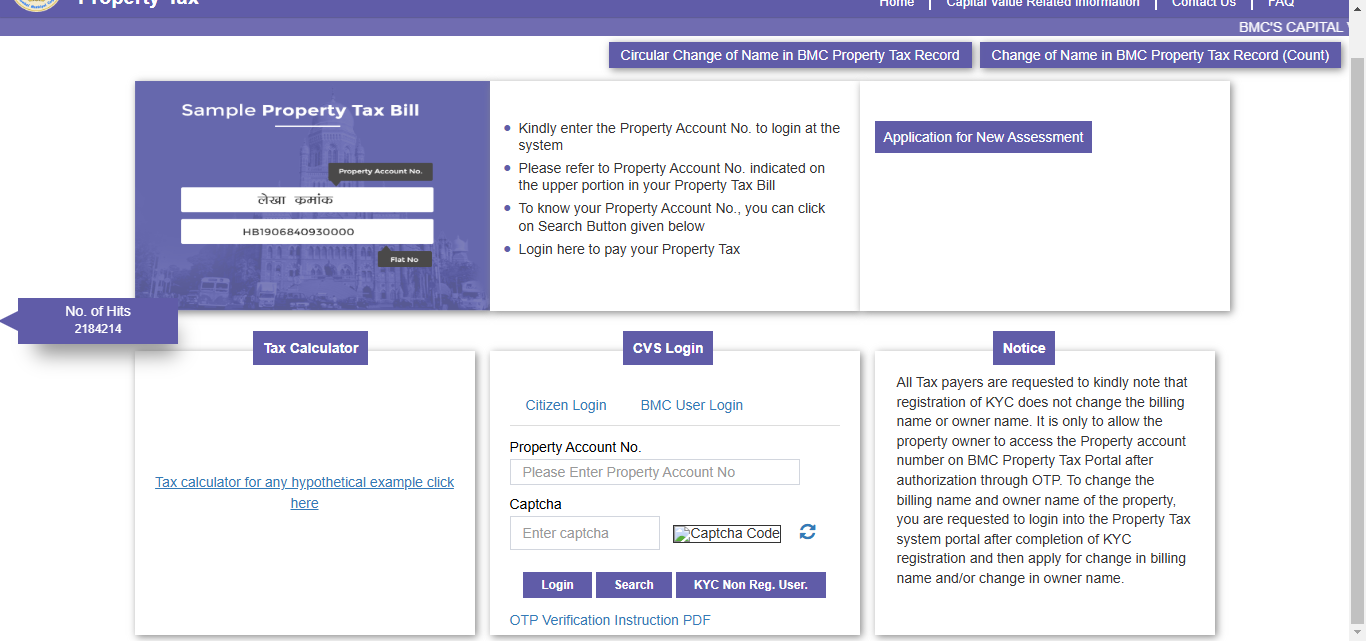

Paying your property tax online is a breeze:

- Visit the official BMC website or mobile app.

- Navigate to the property tax section.

- Enter your Property Account Number (PAN) or property details.

- Verify the details and click ‘Pay Now.’

- Choose your payment mode: credit/debit cards, net banking, or UPI.

- Save the receipt for future reference.

Error Resolution

Facing issues like duplicate payments or incorrect tax calculations? File a grievance online or visit the nearest ward office for resolution.

Exemptions and Benefits

Some properties, such as those owned by charitable organizations or senior citizens, may qualify for exemptions. Check the municipal taxation laws or consult the BMC for specifics.

Common Issues and How to Resolve Them

- Missing Receipts: Check your email or revisit the portal to re-download.

- Ownership Changes: Update property ownership details to avoid discrepancies.

FAQs

How can I check my property tax online in Mumbai?

Visit the BMC (Brihanmumbai Municipal Corporation) property tax portal: BMC Property Tax Portal.

Enter your property account number or ward and property details.

View outstanding or paid tax details.

Can we pay BMC property tax online?

Yes, you can pay property tax online through the BMC portal:Log in to BMC Property Tax Payment.

Enter your property details and view the due amount.

Choose a payment method like UPI, credit/debit card, or net banking.

How to pay property tax online in Thane?

Visit the Thane Municipal Corporation (TMC) website: TMC Property Tax.

Use your property account number to log in and pay.

How much is property tax in Mumbai?

Property tax is based on the capital value of the property, which includes factors like property type, location, age, and user type (residential or commercial).

For residential properties: Tax rates range between 0.316% to 2.296% of the capital value.

Is there no property tax on 500 square feet in Mumbai?

As per the Maharashtra government’s 2019 policy, properties up to 500 square feet (carpet area) in Mumbai are exempt from property tax.

What is the current property tax rate in Mumbai?

Tax is calculated using this formula:

Property Tax = Capital Value × Rate of Tax × User Category Factor

Rates differ for residential and commercial properties.

How to change property tax name online in Mumbai?

Visit the BMC portal and follow these steps:Log in with your credentials.

Upload documents like the sale deed, property registration papers, and ID proof.

Submit an application for name change.

Alternatively, visit your local BMC ward office for assistance.

How to change name in water bill in Mumbai?

Submit an application to your ward office or online via the BMC portal.

Attach documents such as the sale deed, proof of ownership, and ID proof.

How to pay TDS on property?

Use the TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal: TRACES Portal.Fill out Form 26QB (TDS on property transactions).

Pay the TDS using net banking or other methods.

TDS rate: 1% of the property value if it exceeds ₹50 lakhs.

How to pay professional tax online in Mumbai?

Visit the Maharashtra GST Department Portal: Professional Tax Portal.

Log in, choose the professional tax payment option, and pay.

How is BMC property tax calculated?

Formula:

Property Tax = Capital Value × Tax Rate × Weightage Factors

Capital Value: Calculated using Ready Reckoner rates.

Tax Rate: Based on property use (residential or commercial).

Weightage Factors: Includes property age and user category.

What is the new rule of property tax in Maharashtra?

Properties up to 500 square feet in Mumbai are exempt from property tax.

Enhanced digitization for KYC and tax payments.

What is the total capital value of property tax?

Capital value is the market value of the property as per Ready Reckoner rates, adjusted for depreciation, location, and usage.

How to calculate capital value of property in Mumbai?

Formula:

Capital Value = Built-up Area × Rate per Sq. Ft (Ready Reckoner) × Weightage Factors

What is the municipal rent value in income tax?

It refers to the expected annual rent for a property, used to calculate property tax.

How to do KYC for BMC property tax?

Visit the BMC property tax portal.

Enter property details and upload ID and address proof for verification.

What is the KYC for properties?

Property KYC involves verifying ownership through documents like sale deeds, utility bills, and tax receipts.

How do I find my local property tax number?

Check your property tax bill or log in to the BMC portal using your ward details.

How do I get Central KYC registry?

Apply through financial institutions (e.g., banks) to link your KYC details to the CKYC Registry managed by CERSAI.