Paying your VMC property tax is more than just a legal duty—it’s a way to contribute to Vadodara’s growth and sustainability. By leveraging the user-friendly online portal, taxpayers can ensure timely payments, secure transactions, and seamless record-keeping. Stay informed about rebates, exemptions, and the latest developments to make the most of your property tax contributions.

When it comes to owning property, paying taxes is an integral part of responsible ownership. The Vadodara Municipal Corporation (VMC) ensures that property tax collection is transparent and efficient, supporting the city’s growth. But what exactly is VMC Property Tax, and how does it affect you?

What Is Property Tax?

Property tax is an annual levy imposed on property owners, calculated based on property assessment and zonal classification. It is a primary source of funding for public infrastructure and urban development.

Importance of Paying Property Tax

Legal Obligations

Paying property tax is mandatory to avoid legal penalties, including dispute resolution processes or property seizures.

Contribution to Public Services

Your contributions help fund public utilities, green spaces, and sustainable city projects.

How to Calculate VMC Property Tax?

Factors Affecting Property Tax Calculation

- Property Assessment: The taxable area and valuation influence the tax amount.

- Tax Rate Table: Depending on the zonal classification, the rates may vary.

- Usage Classification: Residential, commercial, or industrial usage determines the applicable tax slab.

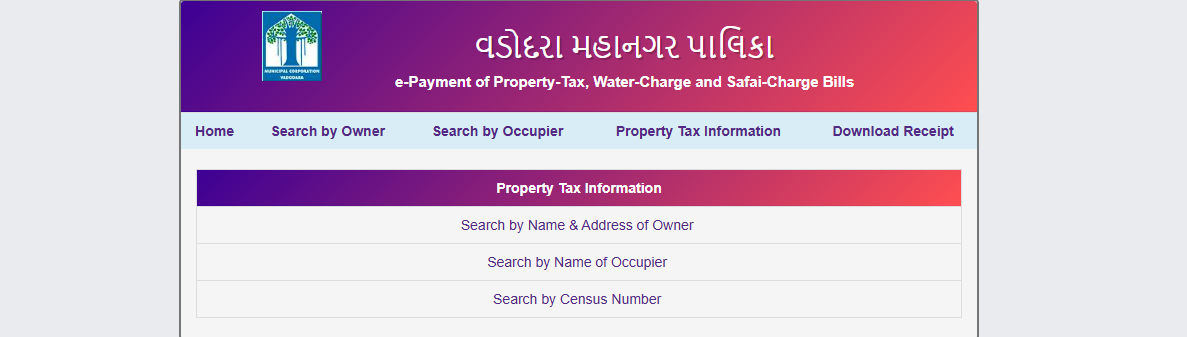

How to Pay VMC Property Tax Online?

Step-by-Step Guide to Online Payment

- Visit the Official Website: Open www.vmc.gov.in. or visit https://vmc.gov.in/proptax/frmsrcbycensusno.aspx (direct access)

- Log In with Security Features: Use your credentials and ensure two-factor authentication for secure access.

- Locate Your Property: Search by property ID, owner name, or survey number.

- Complete the Payment: Choose from multiple options, including QR code payments or net banking.

Downloading VMC Property Tax Receipt

Why Do You Need the Receipt?

Receipts act as proof of payment and are essential for records, dispute resolution, and future audits.

Step-by-Step Guide to Downloading

- Log in to the portal. – https://vmc.gov.in/proptax/frmDownloadReceipt.aspx

- Access the “Payment History” section.

- Select the transaction and download your receipt.

Benefits of the VMC Online Portal

Enhanced Digital Integration

The VMC portal is constantly updated with features like a mobile app, real-time notifications, and a chatbot for assistance.

Secure and Eco-Friendly Transactions

Digital payments reduce paperwork, supporting the city’s eco-friendly policies.

Late Payment Penalties and Legal Implications

Penalties for Delayed Payments

Interest is charged on overdue amounts. Late payers may also face duplicate entry errors and penalty fees.

Legal Actions for Non-Payment

Unpaid taxes can lead to legal proceedings, which might escalate to complaint redressal mechanisms.

Tax Rebates and Exemptions

Who Qualifies for Rebates?

Certain taxpayers qualify for rebates and tax exemptions under specific conditions. These may include:

- Senior citizens

- War widows

- Differently-abled property owners

- Owners of properties used for charitable or educational purposes

How to Apply for Exemptions?

To apply for exemptions or rebates:

- Visit the VMC online portal or the nearest municipal office.

- Fill out the relevant application forms and attach required documents such as identity proofs, property ownership records, or charity certifications.

- Submit the documents online or offline and track the application status through the portal.

Tips to Avoid Common Mistakes

Verifying Property Details

Before making a payment, ensure that all property details, including valuation and survey numbers, are accurate. Errors in the details could lead to incorrect tax calculations or payment failures.

Keeping Payment Records

Maintain a record of all receipts, both physical and digital. These can be crucial in resolving disputes or verifying past payments.

Updating Contact Information

Keep your contact details up to date on the VMC portal to receive timely notifications about payment deadlines, changes in tax rates, or updates to rebate policies.

User Assistance and Complaint Resolution

Common User Issues

Taxpayers often encounter issues such as:

- Delayed Payments: Payments are not reflected immediately in the system.

- Duplicate Entries: Errors in property details causing overcharges.

- Receipt Errors: Missing or incorrect information on receipts.

How to File Complaints?

If you face any issues, you can file a complaint through:

- The VMC help desk at the municipal office.

- The online complaint redressal system is available at www.vmc.gov.in.

- Calling the customer support helpline for real-time assistance.

How VMC Utilizes Collected Taxes?

Urban Development Projects

The funds collected from property taxes are channelled into essential development projects such as:

- Road and Bridge Construction: Ensuring better connectivity.

- Water and Sewage Systems: Upgrading infrastructure to meet growing demands.

- Green Initiatives: Developing parks and promoting eco-friendly practices.

Maintenance of Public Facilities

Property tax also supports the upkeep of existing facilities, ensuring cleanliness, safety, and functionality across the city.

FAQs

How to download the VMC property tax receipt?

Log in to www.vmc.gov.in, navigate to “Payment History,” and download the receipt for the desired transaction.

Does the receipt include a survey number?

Yes, survey numbers are included for proper property identification.

How to check the maguro of the VMC property tax bill?

The major details can be found in the bill summary section of the portal.

How to check the measurement of the VMC property tax bill?

Measurement details are listed under the property information section on the portal.

How to print a duplicate VMC property tax bill?

Access the “Billing” section on the portal, select the relevant bill, and click on “Print Duplicate.”