If you plan to buy or sell property in Maharashtra, you’ve encountered IGR Maharashtra. But what exactly does it mean, and how does it affect you?

Let’s break it down step by step. The Inspector General of Registration Maharashtra (IGR Maharashtra) plays a pivotal role in property transactions and registrations across the state.

IGR Maharashtra plays a pivotal role in ensuring property transactions in the state are conducted smoothly, efficiently, and legally. Understanding how IGR works can save you time and effort, whether buying, selling, or leasing property. With its ongoing digital reforms, the IGR is making strides to simplify processes and enhance security for all property buyers and sellers.

Understanding what the IGR does and how it works can save you time, money, and many paperwork headaches while ensuring that your property transactions are secure and compliant.

What is IGR Maharashtra?

The IGR, or Inspector General of Registration, is the governing body responsible for registering properties and maintaining records in Maharashtra. Imagine managing every property transaction in the state—it’s a huge task! That’s where the IGR comes in, streamlining the process and ensuring that property ownership records are maintained correctly, securely, and transparently. Blockchain technology is expected further to enhance the integrity and security of property records.

The Role of IGR in Property Registration

The primary role of the IGR is to handle property registrations, including verifying documents, collecting stamp duty, and ensuring that the transactions comply with legal requirements. Every property transaction, whether buying or selling, needs to go through this registration process to make the deal legally binding. Recent digital reforms, such as introducing anti-fraud measures, help safeguard transactions.

History and Evolution of IGR Maharashtra

The concept of property registration in India dates back to the colonial period. However, with the advent of modern technology, IGR Maharashtra has evolved, incorporating digital solutions to make property registrations quicker, more efficient, and safer against cyber threats. It’s fascinating how far we’ve come from piles of paperwork to seamless online processes, making the experience more user-friendly.

Critical Functions of IGR Maharashtra

The IGR has several critical functions that benefit the state’s property market. Whether buying a flat or leasing land, the IGR system ensures everything goes smoothly and complies with legal and financial regulations.

Property Registration

First and foremost, property registration is the bread and butter of IGR Maharashtra. Any property transfer, whether through sale, inheritance, or lease, must be registered with the IGR. It ensures that the ownership records are updated and prevents fraudulent transactions.

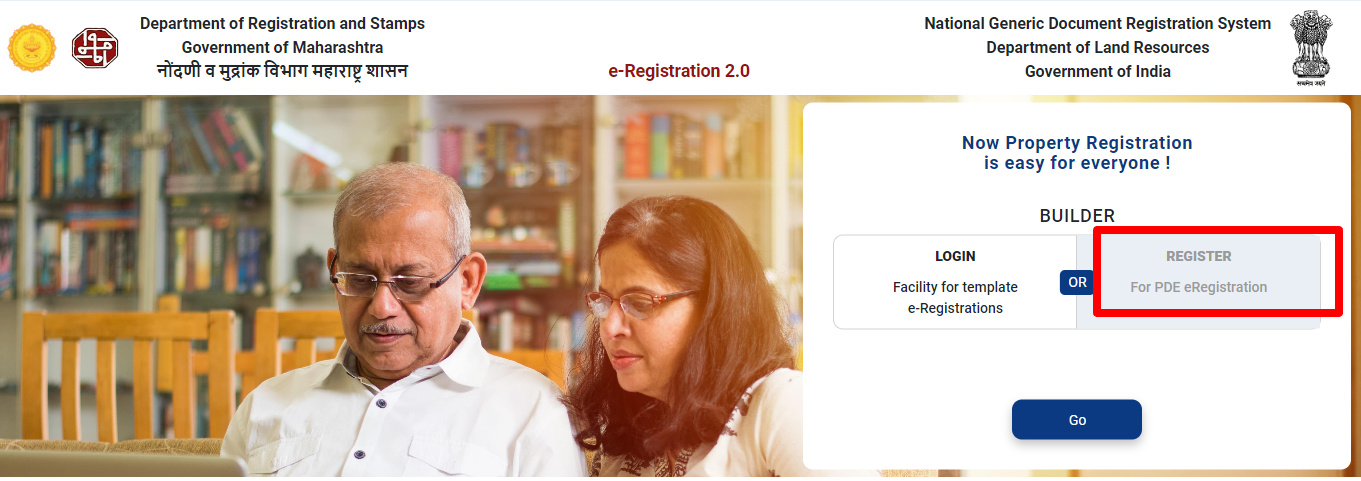

Click Here https://isarita.igrmaharashtra.gov.in/ISARITA2_EREG/To create a new account, first-time users should select the ‘Register‘ option and click the ‘Go‘ button.

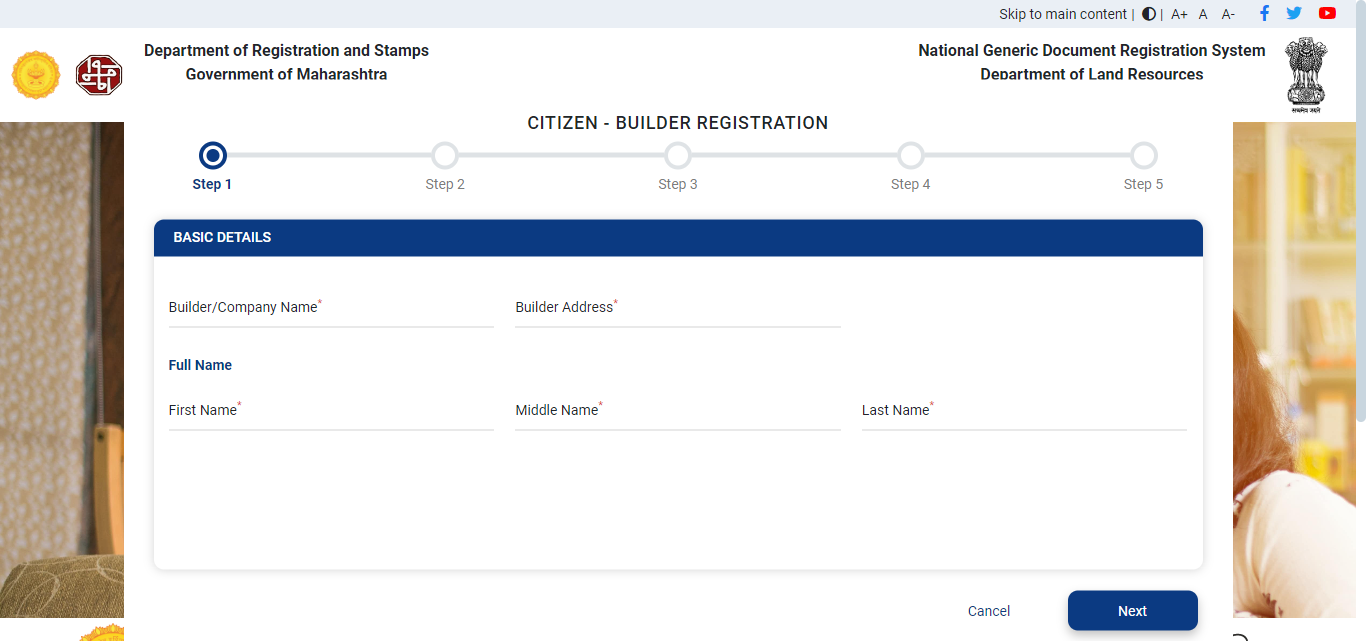

Check the screenshot and filled the details as per the form.

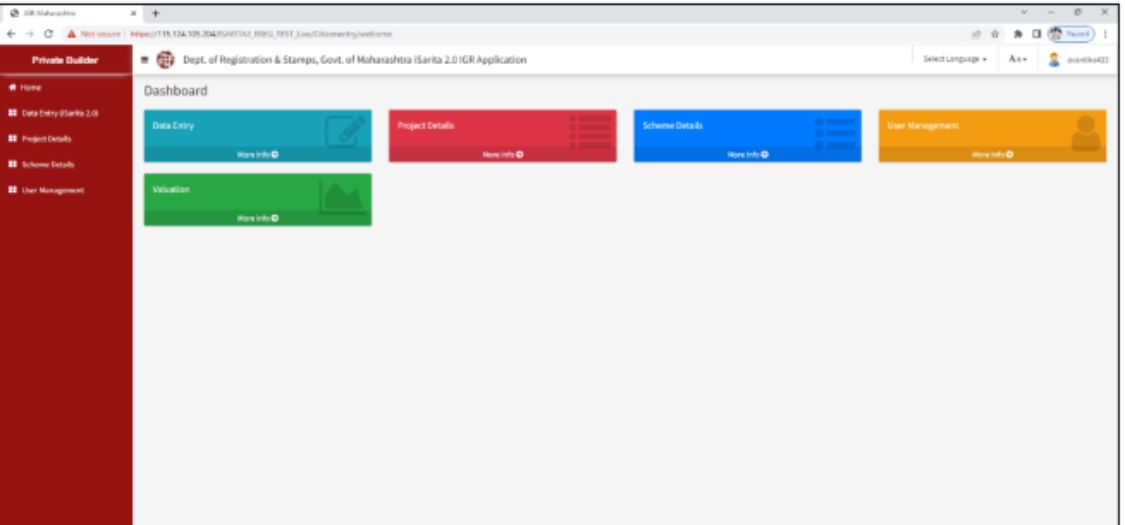

Complete the 5 steps, and you will complete the registration process. After login, the dashboard will look like:

You will find the details on this dashboard below.

Data Entry,

Project Details,

Scheme Details,

User Management,

Valuation

Data Entry

Project Details

Scheme Details

User Management

To view the rate chart:

- Project Details:

- Enter the project name.

- Specify the developer or company.

- Provide the project PAN number.

- Location Information:

- Select the district, taluka, and village from the dropdowns.

- Choose the area type: Influence, Rural, or Urban.

- If applicable (for Urban areas), select the corporation.

- Language and Location:

- Choose the report language: English or Marathi.

- Select the location and sublocation from the dropdowns.

- View Rate:

- Click the “View Rate” button.

- The rate chart will display the applicable rates based on the selected location and usage category.

Check the details and fill out the form.

Scheme Entry:

- Enter Scheme Details:

- Document Type: Select the article type (e.g., Conveyance – Immovable Property with Valuation/Lease).

- Choose the document title (e.g., Agreement to Sale/Agreement for Sale/Articles of Agreement).

- Scheme Information: Enter the scheme name.

- Provide the draft title.

- Input the MAHA RERA number.

- Specify the number of units/flats.

- Mention the project area and select the unit (e.g., hectares).

- Choose the RERA validation date.

- Valuation Details: The rate will be auto-filled.

- Select the valuation rule.

- Indicate if it’s a government organization for a different rule.

- Specify whether the land is on a highway.

- Choose whether a lift is available.

- Select if the corporation is identified.

- Save and Add: After entering the details, click “Save.”

- If there’s a stamp duty exemption, select it.

- To add multiple schemes to the project, repeat the process.

Scheme Details

To access the scheme details, click the “Scheme Details” link and then the “Scheme Details” button.

Seller Master/Scheme Seller Entry:

Seller Master/Scheme Seller Entry:

- Party Category: Select the party category from the dropdown.

- Indicate whether a Power of Attorney (POA) is applicable.

- Specific fields will appear based on the chosen category.

For example:

- Company: Enter company-related details.

- Partnership: Enter partnership details.

- Individual: Enter individual details.

- Power of Attorney: Enter POA details.

- Limited Liability Partnership: Enter LLP details.

- Licensor: Enter licensor details.

- Builder/Purchaser: Enter builder/purchaser details.

After saving the entry, the list of scheme sellers will be displayed at the bottom of the page. You can edit or delete entries using the “Action” section.

E-Governance and Digital Initiatives

Maharashtra’s IGR has embraced e-governance in a big way. By going digital, they’ve simplified a tedious, paper-heavy process. Now, you can perform property searches, check registration status, and even pay stamp duty—all from the comfort of your home. Blockchain-based record systems are also being explored for future implementation, further strengthening security and transparency.

Stamp Duty and Document Registration

The IGR is also responsible for collecting stamp duty—a tax paid when certain documents are executed, including property sale deeds.

Without paying stamp duty, your property transaction isn’t legally valid. The IGR ensures the correct amount is paid and the documents are correctly registered.

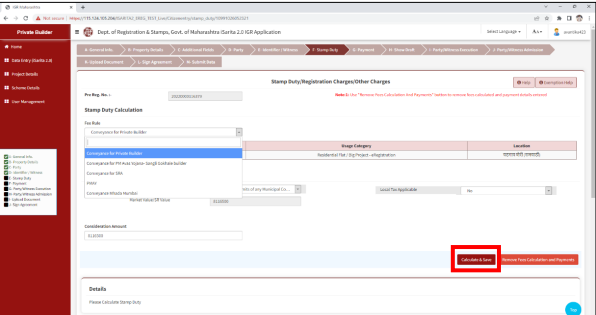

Fee Rule:

- Select the fee rule from the dropdown.

Calculate and Save:

- Click the “Calculate & Save” button.

- The stamp duty calculator will calculate the amount.

- Proceed by clicking “Save & Next.”

Fee Exemption (Optional):

- If applicable, select “Yes” and choose the stamp duty exemption rule.

- Click “Calculate and Save.”

- The fee exemption will be calculated.

5GA Investor Clause (Optional):

Enter the old document number, old document date, and stamp amount.

Payment

In this section, you need to provide details of the payment made. Follow these steps in the Mode of Payment section:

- Select Payment Mode: Choose either E-Challan (GRAS) or e-SBTR.

- Enter Payment Information: Fill in the Challan Number, Challan Date, and Challan Amount in the designated fields.

Once the details are entered, click the ‘Save’ button. The payment information will be displayed in the table at the bottom of the page.

View Draft Agreement

In this section, you can review and download the draft agreement. Available options include:

- Download Draft: View the full draft agreement.

- Download Draft Index 2: Access a summary of the key points in the agreement.

- Download Draft Summary: Get a brief overview of the draft.

Party/Identifier Execution

At this stage, we capture the photos and thumbprints of the parties and identifiers. Please follow these guidelines for photo capture:

- The photo must be in color with a clear, high-quality print.

- It should show the entire face with eyes open and a neutral expression.

- The photo must cover the full head, from the top of the hair to the bottom of the chin.

- Ensure the head is centered and the background is plain white or off-white.

- Avoid any distracting shadows on the face or background.

- No head coverings are allowed unless for religious reasons, and facial features must be visible from the chin to the forehead.

Photo Capture Process:

- Click the ‘Photo Capture’ button.

- Confirm the pop-up by clicking ‘OK.’

- Take the photo using the ‘Take Snapshot’ button, then save it if correct.

The captured photos will be shown in the list.

Thumb Capture Process:

- Click the ‘Fingerprint Capture’ button.

- Confirm the pop-up by clicking ‘OK.’

- Select your fingerprint device (Mantra or SecuGen).

- Place the finger of the concerned person on the device and click the ‘Capture Fingerprint’ button.

- After capturing the thumbprint, click ‘Save.’

The captured thumbprint will appear in the list, along with the associated photo.

Party/Identifier Admission

This section is used for the e-KYC verification of parties and identifiers. Follow these steps for biometric verification:

- Click the ‘e-KYC’ button, then select ‘Biometric.’

- Confirm the pop-up by clicking ‘OK.’

- Review the authentication consent form and agree to the UID verification.

- Select the device (Mantra or SecuGen), enter the UID number, and agree to the Terms and Conditions.

- Place the finger on the biometric device and capture the fingerprint.

Once the e-KYC is verified, you will receive a confirmation notification.

Complete the e-KYC process for all parties and identifiers by following these steps.

Upload Documents

To proceed, you need to upload three types of documents. Follow these file-naming and formatting rules:

- Use only alphabets, numbers, dashes (-), and underscores (_) in the file name.

- Only PDF files are allowed.

Steps to prepare the PDF for upload:

- Open the PDF file in Chrome.

- Press Ctrl + P or click Print.

- Set the destination as Save as PDF.

- Save the file in A4 (portrait) format with a 1-inch margin for the QR code at the top of each page.

Documents to Upload:

- ID Proof (Deed Order:15) – Maximum file size: 1MB.

- Other Annexures (Deed Order:19) – Maximum file size: 10MB.

- Floor Plan (Deed Order:18) – Maximum file size: 2MB.

After selecting the document from your system, click the ‘Upload/Update’ button to complete the process.

Sign Agreement

In this step, you digitally sign the final agreement. Here’s how to sign:

- Click the ‘Sign Agreement’ button to view the final agreement.

- Enter the token number, then click ‘Confirm Sign’.

- The agreement will be displayed on the screen; you can download a copy if needed.

Submit Data

Once all steps are completed, the final submission is made in this section. Before submitting, ensure that all required fields are checked.

- Review the document to confirm all required fields are filled.

- Click the ‘Submit Data’ button to finalize the process.

Once submitted, the application status will update to ‘Submitted.’

Online Services Provided by IGR Maharashtra

Gone are the days of waiting in long queues at government offices. With IGR Maharashtra, most services are now available online, making it more convenient and secure for users. Let’s take a closer look at these services:

E-Search for Property Information

Through the e-Search service, you can search for any registered property within Maharashtra. This is incredibly useful if you’re buying your property and want to ensure no duplicate registration or potential fraud. The data security measures in place help safeguard all transactions.

e-Registration for Property Transactions

One of the most significant conveniences IGR Maharashtra offers is the e-registration of property transactions. This service allows you to register your property without entering the IGR office. With ongoing improvements, IGR aims to make the system even more efficient, offering real-time updates for users to track their application status.

e-Filing of Complaints and Queries

Got a query or a complaint? The IGR’s online portal has a feature where you can file complaints or ask questions directly. It’s a transparent system that ensures your voice is heard. Digital compliance checks are also becoming a part of the system, ensuring that all complaints are processed fairly and swiftly.

Importance of Stamp Duty in Property Transactions

Stamp duty is a crucial part of any property transaction. Without it, your property deal isn’t legally binding. But how exactly is stamp duty calculated? Let’s explore the critical aspects of stamp duty and its importance.

How Stamp Duty is Calculated?

Stamp duty varies based on the property’s value and location. Urban properties generally attract a higher stamp duty compared to rural ones. The IGR Maharashtra portal has a calculator that makes it easy to figure out how much you’ll need to pay. With the inclusion of tools like the Ready Reckoner Rate, the process has been simplified to ensure transparency and fair taxation.

Changes in Stamp Duty Rates Over Time

Over the years, Maharashtra has seen several changes in stamp duty rates. Factors like market conditions and government policies usually influence these fluctuations. Staying updated on these changes is essential for anyone looking to buy or sell property. The IGR website frequently updates information to help users make informed decisions.

Understanding the Ready Reckoner Rate

The Ready Reckoner Rate is another important term in IGR Maharashtra. This is the minimum rate at which properties can be registered, and the government sets it.

What is the Ready Reckoner?

In simple terms, the Ready Reckoner is a government-issued guide to property values in various parts of Maharashtra. It’s updated annually and is used as a reference to calculate stamp duty. This helps maintain fair market practices and prevents underreporting of property values.

How the Ready Reckoner Affects Property Valuation?

If the sale price of a property is below the Ready Reckoner rate, you’ll still have to pay stamp duty based on the Ready Reckoner rate. This ensures that all property transactions are taxed fairly, preventing underreporting property values, a common concern in the real estate market. IGR’s adoption of digital valuation tools helps further mitigate potential fraudulent undervaluation.

Challenges Faced by Property Buyers and Sellers

Despite the many advancements in property registration, buyers and sellers still face a few challenges.

Let’s discuss common issues:

Common Issues with Document Registration

One common issue is the discrepancy in documents. Sometimes, a small error in your papers can cause delays in the registration process. Double-checking your documents before submission can save you a lot of headaches! IGR Maharashtra’s compliance tools aim to minimize these errors and improve verification accuracy.

Recent Updates and Amendments in IGR Maharashtra

The IGR is constantly evolving to meet the changing needs of the real estate market. Let’s explore the most recent updates.

New Stamp Duty Rates

In recent years, Maharashtra has reduced stamp duty rates in certain areas to boost the real estate market. However, the rates can fluctuate based on government policies, so staying current is essential. The IGR website regularly updates these figures to keep users informed.

Upcoming Digital Reforms in Property Registration

The government is also looking into implementing more digital reforms, such as blockchain-based property records, to streamline the process further and reduce the chances of fraud. These reforms are expected to enhance data transparency and protect property owners from cyber threats.

IGR Maharashtra Faqs

What is the complete form of IGR?

The complete form of IGR is Inspector General of Registration, the governing body for property registration in Maharashtra.

How can I register my property online in Maharashtra?

You can register your property online through the official IGR Maharashtra portal by submitting the necessary documents and paying the required stamp duty.

What is the importance of the Ready Reckoner Rate?

The Ready Reckoner Rate is the government-set minimum property value used to calculate stamp duty, ensuring fair taxation.

What documents are required for property registration?

You will need proof of identity, a property sale deed, proof of stamp duty payment, and other related documents for property registration.

How can I check my property details online?

You can use the e-Search facility on the IGR Maharashtra website to check the details of your registered property.

Can a document be downloaded from IGR Maharashtra?

Yes, documents can be downloaded from the IGR Maharashtra website.

Can the agreement be downloaded from the IGR Maharashtra website?

Yes, you can download the agreement from the IGR Maharashtra website.

How to get the IGR receipt for mortgages in Maharashtra?

You can download the mortgage receipt from the IGR Maharashtra website after payment.

How to register on IGR in Maharashtra?

Visit the IGR Maharashtra website, fill in the required details, and complete the registration process.

How to take an appointment for marriage registration on IGR Maharashtra?

Book an appointment through the IGR Maharashtra website under the ‘Marriage Registration’ section.

How can I check my property registration status in Maharashtra?

Check property registration status on the IGR Maharashtra website using the document number or other details.

What is the charge of IGR in Maharashtra?

Charges vary based on the type of document or service; visit the IGR Maharashtra website for the fee details.

Can we get land records from the IGR Maharashtra website?

Yes, land records can be accessed through the IGR Maharashtra website.

Where can I get the property registration details?

Property registration details can be obtained from the IGR Maharashtra website.

What other services are available on this website?

The website offers services like document registration, e-payment, e-KYC, land records, and marriage registration.