Managing your GVMC property tax doesn’t have to be stressful. With online systems in place, payments, checking dues, downloading receipts, and even name changes have become hassle-free. Regular compliance helps avoid penalties and contributes to the development of Visakhapatnam.

What is GVMC Property Tax?

GVMC (Greater Visakhapatnam Municipal Corporation) property tax is a mandatory levy on all properties within the jurisdiction of Visakhapatnam. It helps the municipal body fund public services like road maintenance, waste management, water supply, and more.

Why is Property Tax Important?

Paying property tax ensures the city’s infrastructure is maintained efficiently. It’s crucial for the development of civic amenities, contributing to better roads, parks, drainage systems, and other essential services.

How to Pay GVMC Property Tax Online?

Step-by-Step Guide for GVMC Property Tax Online Payment

Visit the Official GVMC Website:

Go to the official GVMC portal. Look for the “Property Tax” section prominently displayed on the homepage.

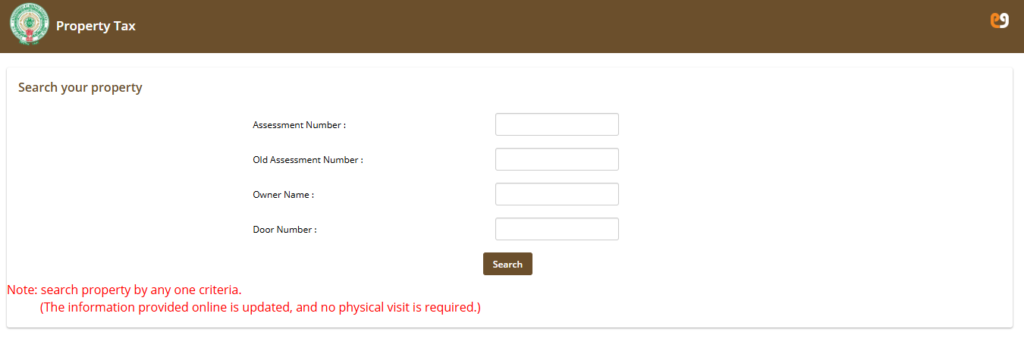

Enter Property Details:

Input your property identification number or assessment number accurately.

Verify and Confirm Payment Details:

Ensure all the details are correct—check for the owner’s name, property address, and tax amount.

Make the Payment Securely:

Choose your preferred payment method (credit/debit card, net banking, UPI) and complete the transaction securely.

Accepted Payment Methods

GVMC accepts multiple payment methods including credit cards, debit cards, net banking, and UPI, ensuring flexibility for all users.

How to Check GVMC Property Tax Online?

Step-by-Step Process to Check Your Dues:

- Visit the GVMC official website.

- Navigate to the property tax section.

- Enter your property ID or assessment number.

- View the outstanding dues and payment history.

Troubleshooting Common Issues:

If you face errors while checking dues:

- Refresh the page or try using a different browser.

- Clear cache and cookies.

- Contact GVMC’s helpline for assistance.

How to Download GVMC Property Tax Receipt?

Downloading Current Receipts:

After payment, navigate to the “Download Receipt” section on the GVMC website. Enter your property ID and download the latest receipt.

How to Download GVMC Property Tax Old Receipts?

- Log into your GVMC account.

- Go to the “Payment History” section.

- Select the year and download the desired receipt.

How to Change Name in Property Tax GVMC?

Required Documents for Name Change:

- Copy of sale deed or legal ownership document

- Identity proof of the new owner

- No Objection Certificate (NOC), if applicable

- Property tax receipt of the current year

Step-by-Step Name Change Process:

- Visit the nearest GVMC office or apply online.

- Submit the application with required documents.

- Pay the applicable processing fee.

- Follow up for status updates.

Common Mistakes to Avoid:

- Incomplete documentation

- Incorrect personal details

- Delay in submission

Benefits of Paying GVMC Property Tax Online

Convenience and Time-Saving:

Online payments eliminate the need for standing in long queues. You can pay anytime, anywhere.

Transparency and Accuracy:

Online systems reduce errors, ensuring your payment history is accurate and easily accessible.

FAQs

How do I pay GVMC property tax online?

Visit the official GVMC website, enter your property details, and pay using your preferred payment method.

How can I check my GVMC property tax dues?

Navigate to the “Check Dues” section on the GVMC website and enter your property ID.

What should I do if I lose my property tax receipt?

You can download a duplicate receipt from the GVMC website’s “Payment History” section.

Is online payment of GVMC property tax safe?

Yes, the GVMC website uses secure encryption protocols to ensure safe transactions.