Paying SDMC property tax isn’t just a legal duty but also a way to contribute to a better community. Understanding tax rates, penalties, and rebates helps ensure smooth compliance and supports the city’s growth.

What is SDMC Property Tax?

Property tax is a mandatory levy imposed by the South Delhi Municipal Corporation (SDMC) on property owners within its jurisdiction. It contributes significantly to the municipal budget, funding vital civic amenities like road maintenance, waste management, and public infrastructure.

Overview of South Delhi Municipal Corporation (SDMC)

The SDMC governs one of Delhi’s most populous areas. It ensures a clean and safe urban environment while tax collections bolster the city’s development projects.

Importance of Property Tax in Urban Development

Have you ever wondered how your city manages to provide services like street lighting and waste collection? Property tax rates play a critical role in shaping the quality of urban development and maintaining municipal operations.

Who Needs to Pay SDMC Property Tax?

Residential Property Owners

Whether you own a bungalow or a studio apartment, if your property is within SDMC’s jurisdiction, you must pay property tax.

Commercial Property Owners

Businesses, shops, and office spaces are also subject to SDMC property tax.

Exemptions and Special Cases

Some properties, such as those belonging to charitable organizations or used for public purposes, may qualify for exemptions. It’s crucial to check for tax amnesty schemes or updated guidelines to verify eligibility.

Calculating SDMC Property Tax

The Unit Area Method (UAM)

SDMC uses the Unit Area Method (UAM), which factors in property size, location, and usage to determine tax liability.

Factors Affecting Property Tax Calculation

- Annual Value of Property: This is the cornerstone of your tax calculation.

- Location and Usage Factor: Premium locations attract higher taxes than less developed zones.

Using SDMC’s Online Tax Calculator

For convenience, the online tax portal offers a calculator to estimate your tax based on your property type, location, and usage.

How to Pay SDMC Property Tax?

Online Payment Methods

Paying online is simple and quick.

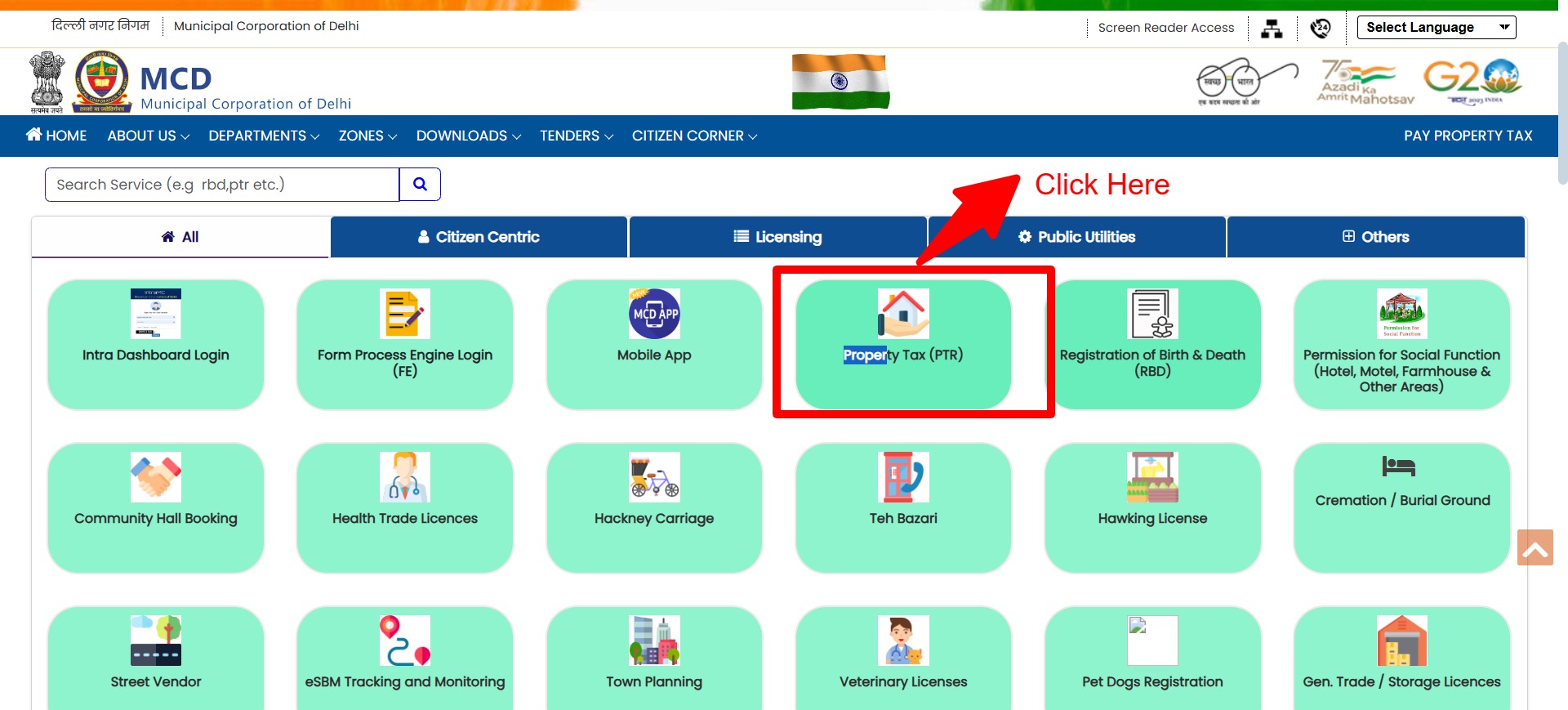

Step-by-Step Guide to Pay Online

- Visit the official SDMC tax portal.

- Navigate to “Property Tax” and input your details.

- Review the tax amount and proceed to payment.

- Download the tax receipt for your records.

Accepted Payment Methods

Credit cards, debit cards, UPI, and net banking are widely supported.

Offline Payment Options

Where to Pay in Person

Head to the nearest zonal tax division office to make your payment.

Documents Required

Bring your previous tax receipts, property documents, and a valid ID.

Penalties and Rebates in SDMC Property Tax

Penalties for Late Payment

Missed the deadline? Late payments incur penalties, including late payment charges that can grow over time.

Rebates and Discounts Offered by SDMC

- Early Payment Discounts: Pay early and enjoy significant rebates.

- Concessions for Senior Citizens: Special discounts make it easier for seniors to fulfil their tax obligations.

Common Issues and How to Resolve Them

Incorrect Tax Calculation

Errors in tax amounts can be resolved by filing a complaint through the grievance redressal system or visiting the SDMC office.

Payment Failures in Online Systems

Encounter a glitch? Retry using an alternative payment method or contact SDMC’s helpline.

Disputes and How to Address Them

For disputes, file an official complaint with the tax grievance cell and provide supporting documents.

Why Staying Updated is Crucial?

Policy Updates

Changes in property tax filing policies or rebates can significantly impact your payment. Stay informed by regularly visiting the SDMC website.

Regular Notifications

The SDMC online portal provides timely updates about deadlines and tax payment schedules.

FAQs

How do I pay property tax in SDMC Delhi?

You can pay SDMC property tax online through the official MCD website. Navigate to the property tax section, log in with your credentials, and complete the payment.

How can I get my UPIC number in SDMC?

The UPIC (Unique Property Identification Code) number can be obtained by visiting the SDMC property tax portal and entering property details like zone, ward, and property address.

Are SDMC and MCD the same?

SDMC is one of the divisions of the Municipal Corporation of Delhi (MCD), catering specifically to the South Delhi region.

What is the last date for MCD property tax in Delhi?

The last date for property tax payment typically falls in the first quarter of the financial year, often by June 30. Late payments may incur penalties.

What is the age factor for MCD property tax?

Senior citizens may receive discounts or exemptions on property tax in certain categories. The age factor varies based on SDMC rules.

How to remove MCD booked property?

You need to approach the MCD office with the relevant documents proving the legality of the property and pay any pending dues for de-booking.

Who needs to pay property tax in Delhi?

Property owners in Delhi, including residential, commercial, and vacant landowners, are required to pay property tax.

Is MCD under the Delhi government?

Yes, the Municipal Corporation of Delhi operates under the jurisdiction of the Delhi government but functions as an independent body.

Do senior citizens pay property tax in India?

Senior citizens may get concessions or exemptions on property tax, depending on the rules of the municipal body.

How to get a no-dues certificate from MCD property tax online?

Log in to the MCD property tax portal, check for dues, and clear all payments. Once settled, you can apply for a no-dues certificate online.

How to pay the property tax in South West Delhi?

Visit the SDMC property tax portal, select the zone and ward, and follow the steps to pay the property tax for your property in South West Delhi.

How to find the property ID number online?

You can find the property ID number on your previous property tax receipts or by searching on the MCD property tax portal using address details.

What is the UPIC account number?

The UPIC account number is a unique identifier assigned to each property for tax purposes. It helps in managing and paying property taxes.

How to check property details online in Delhi?

Visit the MCD property tax website, enter your UPIC or property ID, and access details like ownership, tax dues, and payment history.

How to change the owner name in property tax records in Delhi?

Submit a written application to the SDMC office with documents like a sale deed, mutation certificate, and ID proof to request a name change.

How to calculate property tax in Delhi?

Property tax is calculated using the formula:

Tax = Annual Value × Rate of Tax

Annual value depends on property type, location, size, and usage.

How to add a property in the MCD app?

Log in to the MCD app, select “Add Property,” and provide property details, including UPIC and zone/ward information.

How do I get an MCD mutation certificate?

Apply for a mutation certificate online or at the local SDMC office with documents like the sale deed, death certificate (if applicable), and ID proof.

What is the penalty for property tax in Delhi?

Late payment of property tax can incur a penalty of 1% per month on the outstanding amount.

What is the discount on property tax in Delhi?

A 15% rebate is usually offered for early payment, often by June 30 of the financial year.

What is geo-tagging of property?

Geo-tagging is the process of associating a property’s geographical location with its digital property ID for accurate identification and tax assessment.

How can I pay my South Delhi property tax online?

Access the SDMC website, log in with your UPIC, verify property details, and pay the tax online using available payment methods.

How to pay property tax online in Delhi with a UPIC number?

Use the UPIC number to log in to the SDMC property tax portal, select your property, and proceed to payment.

How can I pay my property taxes online in Delhi EDMC?

Visit the EDMC property tax portal, log in with your credentials or UPIC, and complete the payment.

What is the real name of MCD?

The full name of MCD is the Municipal Corporation of Delhi.

How to get a no-dues certificate from MCD property tax online?

After clearing all dues on the MCD portal, apply for the no-dues certificate in the services section.

How to get NOC from MCD?

Visit the nearest MCD office, submit the required documents, and apply for the NOC after fulfilling all compliance requirements.

What is the full form of MCD toll tax?

The full form is Municipal Corporation of Delhi Toll Tax.

What is the MCD tax for entering Delhi?

The toll tax varies based on vehicle type and is collected at entry points to the city by the MCD.

What is the area of SDMC?

SDMC covers the South Delhi region, including areas like Kalkaji, Green Park, and Vasant Kunj.

Which zone is Kalkaji in?

Kalkaji falls under the Central Zone of SDMC.

Who is the IAS officer of MCD Delhi?

The IAS officer is the Municipal Commissioner of MCD. You can find the latest name on the MCD official website.

Which area comes under the South Delhi Municipal Corporation?

SDMC includes localities such as Hauz Khas, Saket, Defence Colony, and Mehrauli.

Where is the headquarters of SDMC?

SDMC headquarters is located at Dr. S.P. Mukherjee Civic Centre, Minto Road, New Delhi.

What is the deadline for paying SDMC property tax?

Deadlines are typically announced at the start of the financial year. Visit the SDMC portal for exact dates.

Can I pay my SDMC property tax in instalments?

Yes, SDMC allows instalment payments, especially for high-value properties.

What should I do if I lose my property tax receipt?

Download a duplicate from the SDMC online portal using your property details.

Are there penalties for incorrect tax payments?

Incorrect payments may attract fines. Double-check your calculations or use SDMC’s online tax calculator.

How can I access the grievance redressal system?

You can file a complaint through SDMC’s helpline or visit the nearest zonal office.